He waited for a pie to fall from the sky, but not even a crumb showed up.Dreams might fall someday—but dinner won’t wait that long.So […]

Continue readingThe Untaken Road

A teen was walking alone on an empty city street. People asked, ‘Why not take the crowded road where everyone else goes?’ He said, ‘Because […]

Continue readingLeg Day, Dignity Lost

After lying flat too long, my legs forgot how to stand with self-respect.Now they wobble like a baby’s first steps—except no parents are cheering, just […]

Continue readingWhen Love Speaks

Love is the gravity that keeps two souls from drifting apart. Love is the spark that turns silence into music. Love is the starlight that […]

Continue readingLife Lessons in Circles

Elderly people don’t even need validation—they automatically see themselves as the best life teachers. Ask them for directions, and you’ll get a 40-minute lecture on […]

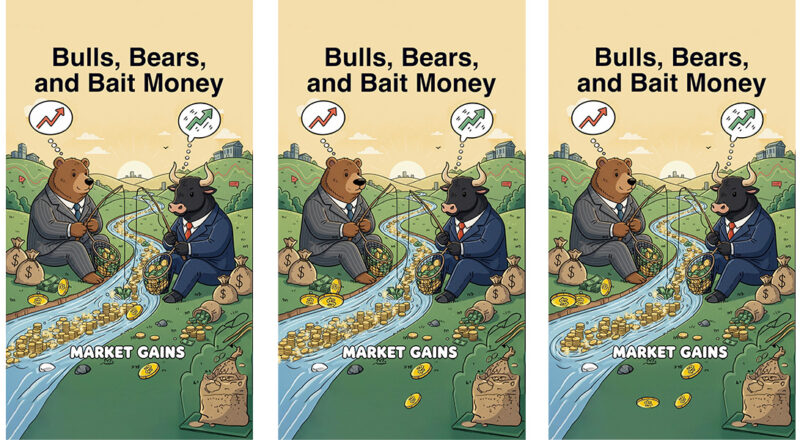

Continue readingBulls, Bears, and Bait Money

At the riverbank, the Bear and the Bull sat in suits, fishing for money.The Bull bragged, “See? The current’s strong—big gains today!”The Bear smirked, “Relax. […]

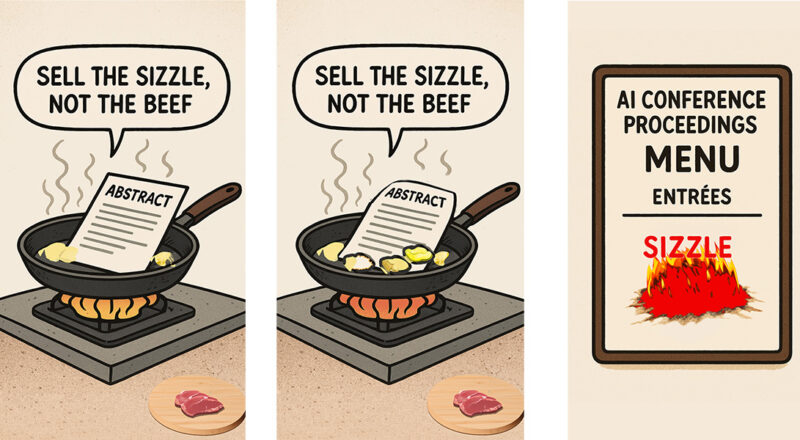

Continue readingSell the sizzle, not the beef

Academic research these days is like that old marketing line: “Sell the sizzle, not the beef.”Most AI papers? No beef at all. Just a frying pan […]

Continue readingNotes of Kindness

I played the lute with a few wrong notes for the cow.She pretended to enjoy it — even mooed in tune — sparing me the […]

Continue readingBack to Simple

I tried to understand the complexity of the world—then realized it was easier to just choose a simple life. As simple as possible, as quiet […]

Continue readingWall Street’s Bubble Act

The Wall Street Bull isn’t charging—it’s blowing bubbles. Investors cheer, “Look, they’re growing higher! Spectacular!”But bubbles don’t last. One pop, and suddenly the cheers are […]

Continue reading